Cultivating Gains: Investment Strategies in Agriculture

Investment Strategies in Agriculture, encompassing farming, livestock rearing, and fisheries, presents a unique landscape for investors. It’s a dynamic industry influenced by global factors like climate change, population growth, and evolving consumer preferences. Yet, agriculture also offers the potential for steady returns and positive social impact. Here, we delve into various investment strategies in agriculture, outlining their benefits, risks, and considerations for making informed decisions.

Understanding the Agricultural Investment Landscape

Asset Classes Investment Strategies in Agriculture:

- Direct Land Ownership: Purchasing farmland offers long-term capital appreciation potential and rental income through leasing to farmers. However, it requires significant capital, expertise in land management, and carries risks like fluctuating land values and dependence on weather patterns.

- Agricultural Stocks: Investing in publicly traded companies involved in agricultural production, processing, or equipment manufacturing provides exposure to the sector’s growth without the burden of direct ownership. Researching individual companies and understanding market trends is crucial.

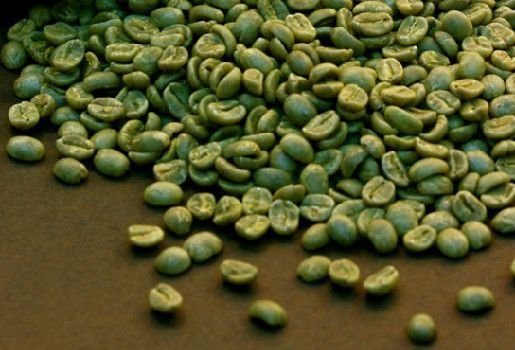

- Commodities Investment Strategies in Agriculture: Investing in agricultural commodities like grains, coffee, or sugar allows for participation in the global food market. However, commodity prices are highly volatile due to supply chain disruptions, weather events, and government policies.

- Real Estate Investment Trusts Investment Strategies in Agriculture: Investing in agricultural REITs offers diversification and professional management. These REITs own and manage farmland, warehouses, or other agricultural infrastructure, generating income through rent collection.

- Private Equity and Venture Capital: High-net-worth investors can consider private equity or venture capital funds focused on innovative agricultural technologies, sustainable practices, or alternative protein sources. These investments are typically illiquid and carry higher risks but offer the potential for high returns.

Investment Strategies Investment Strategies in Agriculture:

- Thematic Investing: Focus on specific themes within agriculture, like organic farming, precision agriculture (utilizing technology for data-driven farming), or alternative proteins (plant-based meat or insect protein). This aligns investments with social and environmental goals.

- Income-Oriented Investing: Prioritize investments that generate regular income streams, such as farmland REITs, dividend-paying agricultural stocks, or lending to farmers through agricultural credit platforms.

- Growth-Oriented Investing: Target companies or sectors poised for significant future growth, like vertical farming technologies or companies developing climate-resilient crop varieties. This strategy involves a higher risk tolerance.

Factors to Consider Before Investing in Agriculture

- Risk Tolerance: Agricultural investments can be volatile due to weather dependence, commodity price fluctuations, and economic factors.

- Investment Horizon: Direct land ownership or private equity funds often have longer investment horizons compared to publicly traded stocks or commodities.

- Investment Goals: Align your investment strategy with your financial goals, whether seeking regular income, capital appreciation, or positive social impact.

- Regulatory Environment: Government policies regarding land ownership, agricultural subsidies, and trade agreements can influence returns. Stay informed about regulatory changes.

- Sustainability Practices: Consider investing in companies or practices that promote sustainable agriculture, minimizing environmental impact and ensuring long-term productivity.

Emerging Trends in Agricultural Investment

- Precision Agriculture: Utilizing data analytics, sensors, and automation to optimize crop yields, resource use, and pest management.

- Climate-Smart Agriculture: Investing in technologies and practices that improve agricultural resilience to climate change, such as drought-resistant crops or regenerative farming practices.

- Vertical Farming: Growing crops in vertically stacked layers indoors, offering potential for increased productivity and reduced dependence on land and weather.

- Alternative Proteins: Investing in companies developing plant-based or insect-based meat alternatives to cater to the growing demand for sustainable protein sources.

Conclusion Investment Strategies in Agriculture

The agricultural sector offers a plethora of investment opportunities. By understanding various asset classes, investment strategies, and considering key factors, investors can make informed decisions and participate in the growth of this essential industry. Remember, thorough research, diversification, and a long-term perspective are crucial for navigating the unique risks and rewards of agricultural investments. As the world grapples with food security challenges and explores sustainable solutions, agriculture presents itself as a potential source of financial gain while contributing to a more secure and sustainable future.